Exness Minimum Deposit in Morocco: What Traders Need to Know

When it comes to trading in the financial markets, choosing the right broker is crucial. One of the important aspects to consider is the minimum deposit required by the broker. For traders in Morocco, Exness offers a viable option with its competitive minimum deposit policies. In this article, we will explore the Exness minimum deposit in Morocco, the various account types available, and factors that Moroccan traders should consider before opening an account. For more detailed insights, you can visit Exness Minimum Deposit in Morocco https://morocco-trades.com/fr/exness-depot-et-retrait/.

What is Exness?

Exness is a well-known online forex and contracts for difference (CFDs) broker that caters to traders all around the globe, including Morocco. Established in 2008, the company has gained a strong reputation for its competitive trading conditions, excellent customer service, and a wide range of trading instruments. Exness provides traders with access to various assets, including forex pairs, commodities, indices, and cryptocurrencies, on its robust trading platforms.

Minimum Deposit Requirements

One of the main attractions of Exness for Moroccan traders is its flexible minimum deposit requirements. Depending on the type of trading account you choose, the minimum deposit can vary significantly.

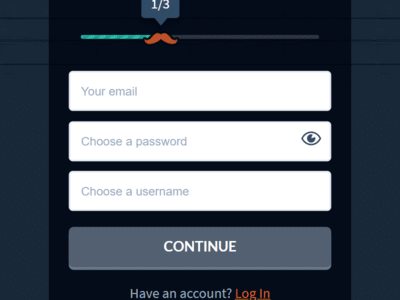

Account Types

- Standard Account: The minimum deposit for a Standard Account is relatively low, starting from just $1. This account type is ideal for beginners who want to start trading with a limited budget and gradually increase their exposure as they gain more experience.

- Pro Account: This account type is designed for more experienced traders and requires a minimum deposit of $200. The Pro Account offers tighter spreads and higher leverage, making it suitable for traders who wish to engage in high-frequency trading and require better trading conditions.

- Raw Spread Account: The Raw Spread Account has a minimum deposit requirement of $400. It is tailored for professional traders who seek the lowest spreads possible and are willing to pay a commission for each trade. This account type is best suited for those who trade large volumes and need the best price execution.

- ECN Account: For traders looking to engage in market-making strategies, the ECN Account is an option, requiring a minimum deposit of $1,000. This account type offers direct access to the interbank market and is mainly suited for high-frequency traders and institutions.

Advantages of Trading with Exness in Morocco

There are several advantages for Moroccan traders choosing Exness as their broker. Some of the notable benefits include:

- Low Minimum Deposit: Exness allows you to start trading with only $1, making it accessible for all traders, including those with limited funds.

- Multiple Account Types: With different account types to choose from, traders can select an account that suits their trading style, experience level, and financial goals.

- Variety of Trading Instruments: Exness offers a wide range of trading instruments, including more than 100 forex pairs, as well as commodities, stocks, and cryptocurrencies.

- Robust Trading Platforms: Traders can access the Exness trading platform via MetaTrader 4 and MetaTrader 5, both of which are highly regarded in the trading community for their functionality and user interface.

- Excellent Customer Support: Exness is known for its responsive customer support team, available 24/7 to assist traders with any queries or issues they may have.

Considerations for Moroccan Traders

Before investing with Exness or any other broker, Moroccan traders should keep a few things in mind:

- Regulation: Ensure you understand the regulatory environment in which Exness operates, as this affects your rights as a trader and the security of your funds.

- Trading Costs: Consider the spreads, commissions, and any other costs that may be associated with the different account types.

- Withdrawal Times: Understand the withdrawal processes and timescales, especially if you need fast access to your funds.

- Market Conditions: Stay informed about the market conditions and economic factors that may affect your trading strategies and decisions.

- Educational Resources: Take advantage of educational resources provided by Exness to enhance your trading knowledge and skills.

Conclusion

In conclusion, the Exness minimum deposit in Morocco is appealing, particularly for new traders looking to enter the financial markets without considerable financial risk. With a variety of account options, excellent customer service, and a strong trading platform, Exness stands out as a broker worth considering. Nevertheless, it’s essential for each trader to evaluate their strategies, risk tolerance, and investment objectives carefully before getting started. Whether you’re a beginner or an experienced trader, Exness offers features that can support your trading journey in Morocco.